Continuing our “Outperform” blog series, we delve into how we continuously enhance our Global Watchlist Monitoring Solution performance — and the tangible benefits this brings to our customers. For previous installments, see part one on DocV and part two on Socure Verify.

—–

Compliance professionals are under increasing pressure from regulators to adhere to sanction screening and enforcement regulations. Legacy sanctions screening solutions are failing to deliver the accuracy and operational scale to meet these demands. These shortcomings lead to high false positives and labor-intensive manual reviews, which drive up operational costs while ultimately risking costly regulatory enforcement actions, including consent orders.

Here’s how traditional watchlist screening typically works:

- Users provide identifying information like name, date of birth, and address.

- The compliance system checks this information against various watchlists.

- The system flags potential matches based on name similarity and other factors.

- Compliance officers manually review flagged cases to determine true matches.

For decades, sanctions screening solutions have relied on basic name matching techniques that bring forward nearly any potential match. As online account opening has scaled, these methods alone are now insufficient, as evidenced by FinCEN’s analysis of suspicious activity reports (SARs). Out of 3.2 million SARs filed, approximately 1.6 million — or 42% — were due to deficiencies in identity verification. This high rate of false positives and negatives underscores the urgent need for more sophisticated solutions.

Socure has emerged as a leader solving these challenges in this space, leveraging advanced AI and machine learning to deliver unparalleled accuracy and efficiency. We have moved beyond basic name matching techniques and delivered immediate returns for customers.

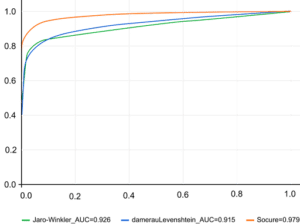

With Socure’s innovative AI-powered Global Watchlist Screening with Monitoring solution, we have achieved a remarkable 20% increase in sanctions screening accuracy compared to competitors (see below), along with a 30% reduction in false positives. This enhancement streamlines operations and allows teams to focus on higher-value tasks.

Socure offers the market’s only solution with comprehensive entity resolution capabilities. This method integrates input data—such as initial personal identifiers including names, addresses, and dates of birth—with watchlist data– using sophisticated analytics to match the input data against regulatory, PEP, and adverse media data sources – resolving them to the entity in real life from government, credit, educational records and more – to identify the most accurate potential matches.

This sophisticated process allows us to deliver a holistic score assessing whether the identity matches one in the watchlist, even amid common names. Our entity correlation score effectively eliminates over 70% of false positives, a common issue with providers that rely solely on name matching, thereby ensuring a more accurate and secure identification process.

Superior Accuracy and Efficiency with Two-Stage Scoring

The key to our success is the industry’s first two-stage scoring system, complemented by robust operational controls. Initially, the solution leverages advanced entity resolution to generate a name match score, pinpointing potential matches based on customer-defined tolerances. This process not only creates a “candidate pool” but also aids clients in demonstrating robust sanctions compliance effectively.

Beyond simple name matching, Socure considers additional factors such as addresses, dates of birth, and national IDs. This holistic approach ensures a more comprehensive risk assessment, leading to more precise matching. Socure’s machine learning models excel at matching names by recognizing complex patterns and variations that traditional methods miss. This includes understanding etymology, commonality indices, and other contextual information.

Socure’s proprietary deep learning models outperform long-held industry standard techniques and perform precise matching, even in the presence of variations, misspellings, or different name orders. The result is unparalleled accuracy and reliability in compliance, achieving near 98% area under the curve (AUC), compared to the legacy models Damerau-Levenshtein algorithm at 91.5% and the Jaro-Winkler algorithm at 92.6%.

Socure vs. Legacy Name Matching Technique: Sharp Reduction in False Positives

Socure has dramatically improved the accuracy of watchlist name matching algorithms, with watchlist name degradation rates, indicating the resilience against noise variations such as alias changes, partial matches, nickname inconsistencies, and more, improving from 81.8% to an impressive 99.2% in our latest release. This increase in accuracy represents insurance against compliance risk and enforcement action.

From the potential name matches we surface, each personally identifiable information (PII) element is scored for relevance, elevating the correct profile and producing an overall entity correlation score. This second score assesses the likelihood that the customer and the source list match are indeed the same person, answering the same question an analyst addresses in a manual review thus eliminating the main burden of a manual review. For instance, a high name match score paired with a low entity correlation score indicates a false positive. Socure’s clients can automate the dispositioning of irrelevant matches with customizable tolerance thresholds, thereby saving time and resources.

This method not only minimizes false positives but also reduces the need for manual intervention, resulting in a 60% savings in resource and staffing costs due to fewer reviews and less time spent on the remaining ones.

This level of precision is unmatched in the industry and ensures that businesses can scale compliance without the burden of excessive false positives/negatives and analyst resources for manual reviews which can be reassigned to higher value tasks.

Slashing Manual Review Time by 75%

For cases that do require further review, Socure’s intuitive case management system speeds up analyst review by combining automated case generation and assignment with AI that provides detailed entity resolution analysis, audit explainability, and a system-generated recommended course of action. Analysts can then accept the disposition with a single click and have all of the supporting contextual information stored for future reference in the case of a regulatory exam.

Through our efforts, we’ve reduced manual review time by 75% — from 10 minutes to just 2.5 minutes.

Solving Adverse Media Screening Challenges

Traditional adverse media risk screening methods have been bogged down by overwhelming false positives due to simplistic boolean string match criteria used by legacy solutions. This makes adverse media almost unusable with the volume of irrelevant hits. Socure has overcome this issue with a novel approach that employs NLP and deep learning to perform contextual risk assessment to achieve 91% real world accuracy for PEP and adverse media, nearly eliminating false positives commonly associated with these risk assessments.

For example, Socure’s technology can accurately classify an article about a high number of shots in a basketball game as related to sports, avoiding the incorrect match for violent crime that legacy keyword matching might produce. This advanced capability significantly enhances the accuracy and relevance of adverse media screening, ensuring more precise risk assessments and reducing the burden of false positives.

Transform your compliance operations with Socure

Socure has introduced watchlist innovations that enable compliance leaders to reduce the noise, sharpen accuracy, and elevate operational efficiency. Socure’s commitment to continuous improvement sets it apart from the competition. By constantly refining its algorithms and incorporating new data, Socure ensures that its solutions remain at the cutting edge of compliance technology. This proactive approach means that businesses using Socure can always rely on the most accurate and effective screening tools available.

Stay tuned for our next blog in the Outperform series — coming soon!

Josh Linn

Leading digital identity verification and authentication strategy for a top 10 FI before joining Socure in 2018 to lead Data Acquisition efforts, Josh Linn now serves as Senior Vice President of Machine Learning Product Management & GM of RegTech leading innovation for the regulatory compliance and predictive analytics platforms. He holds and MBA from Syracuse University and a Master's of Science in Information Systems from Northwestern University.